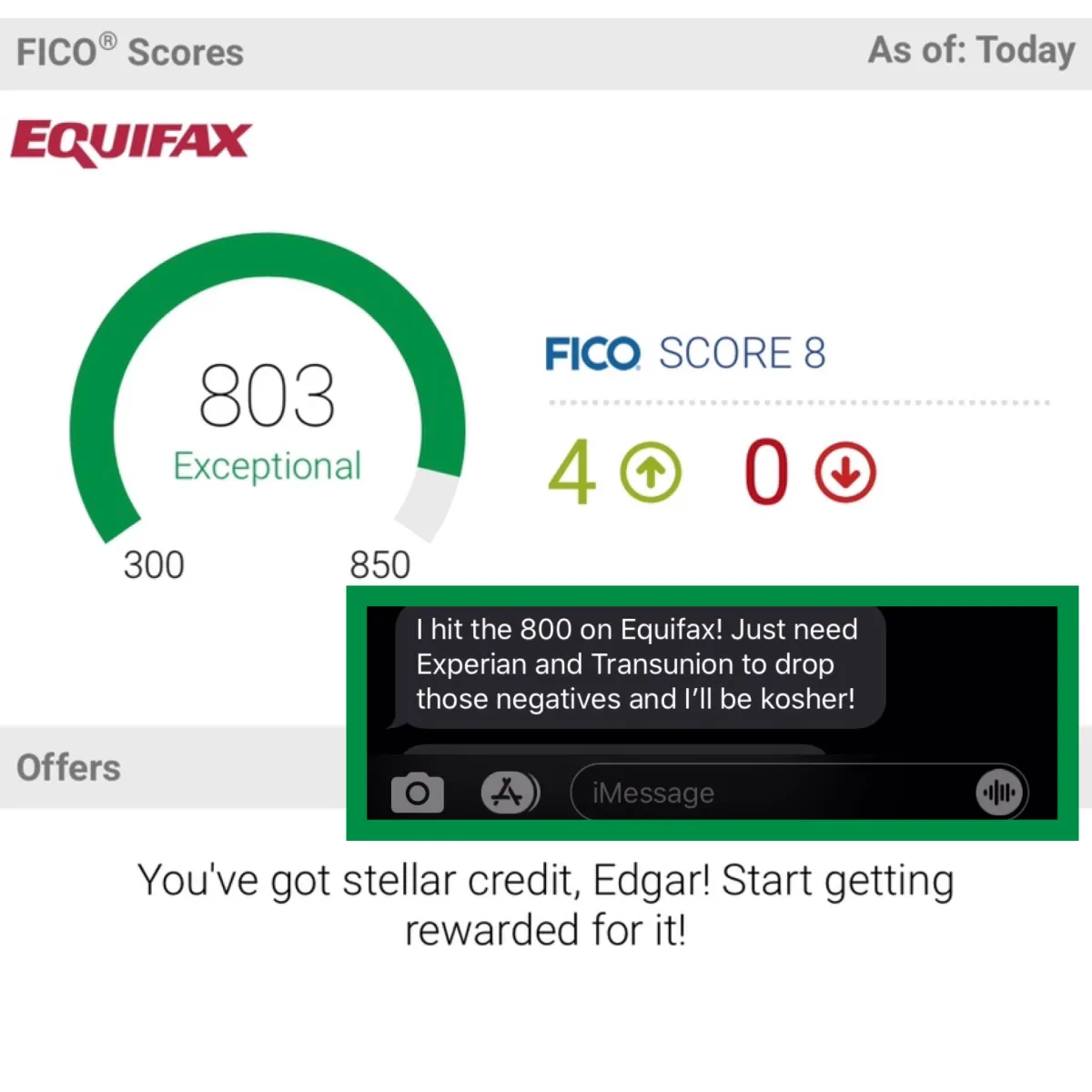

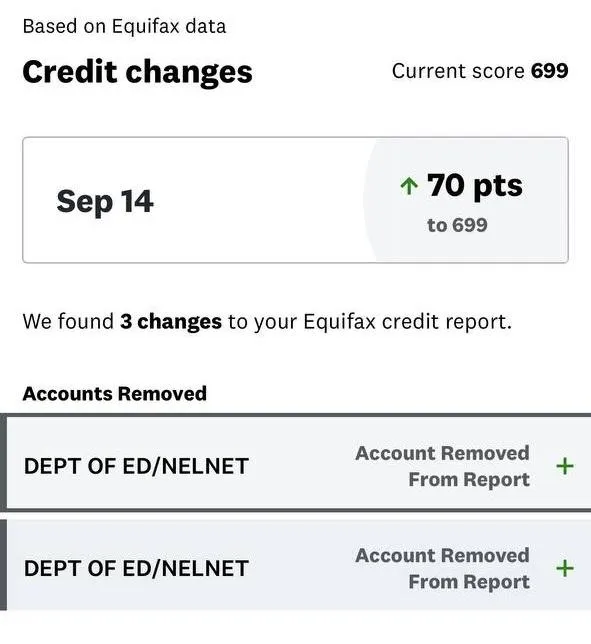

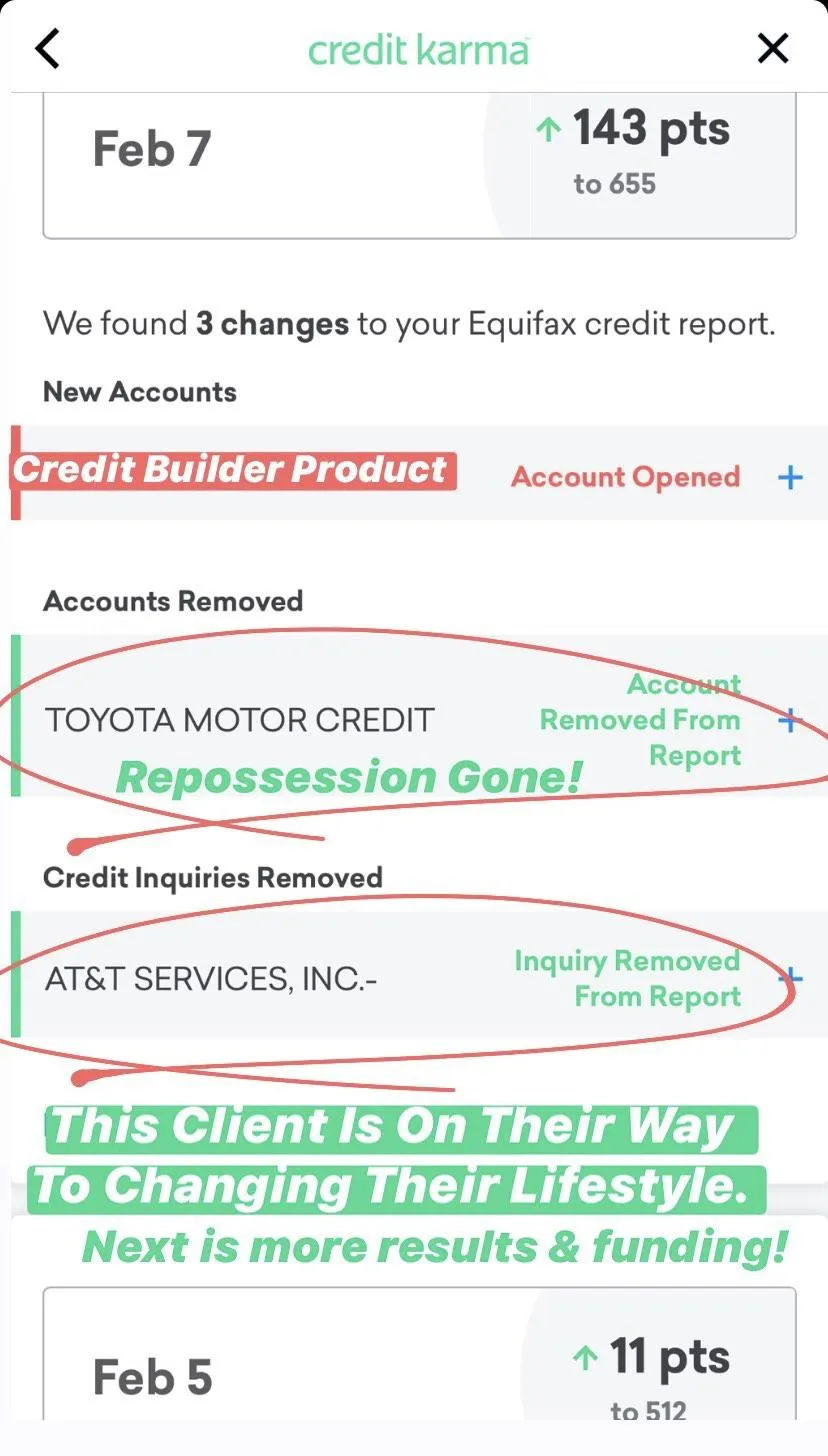

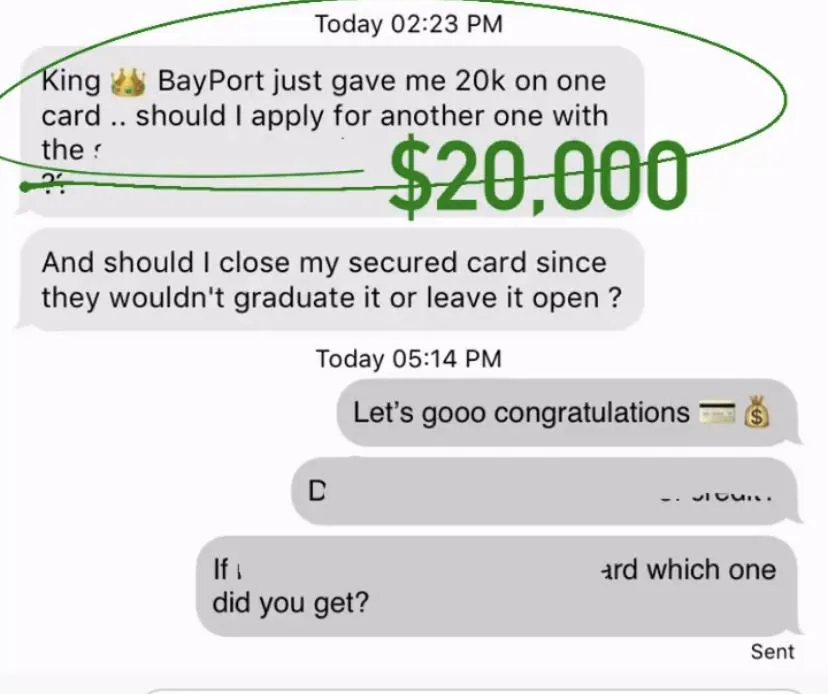

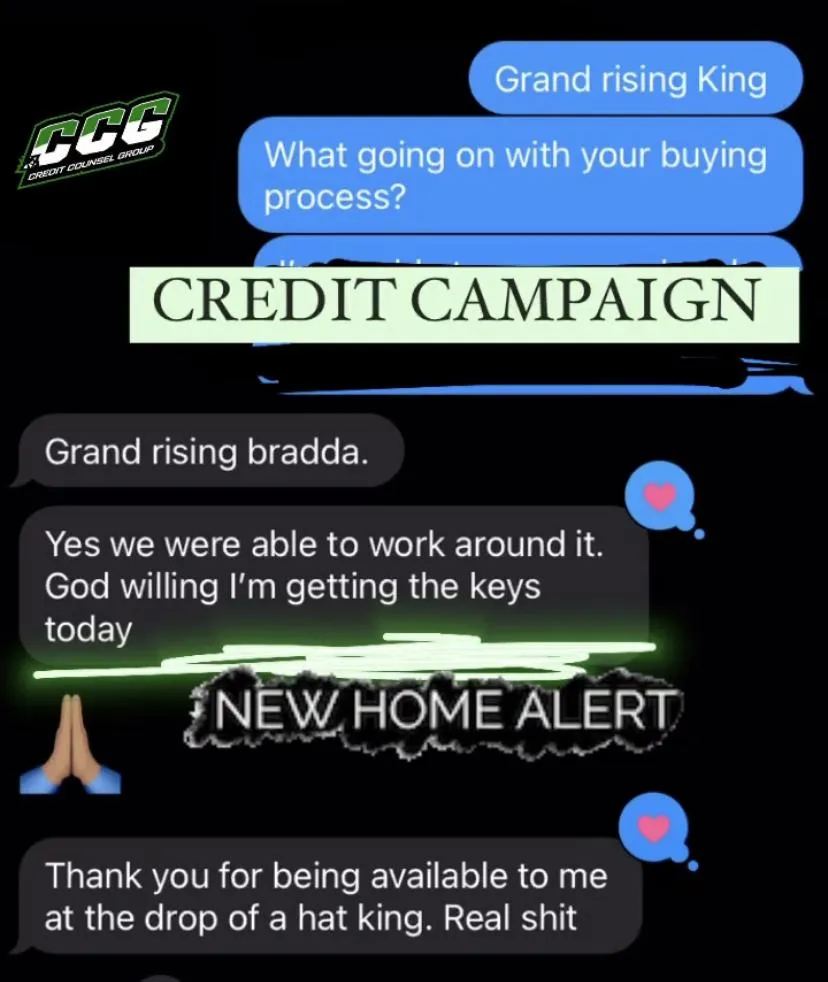

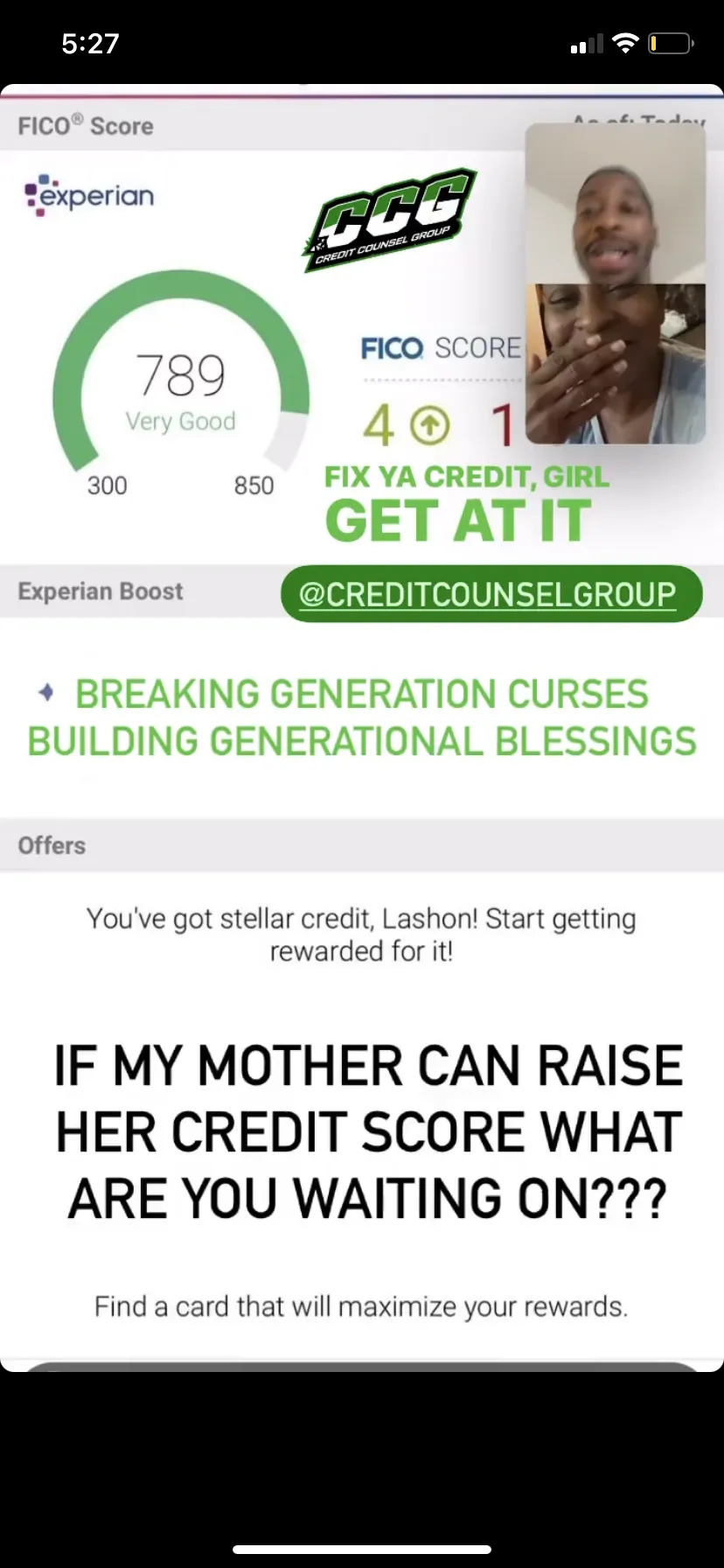

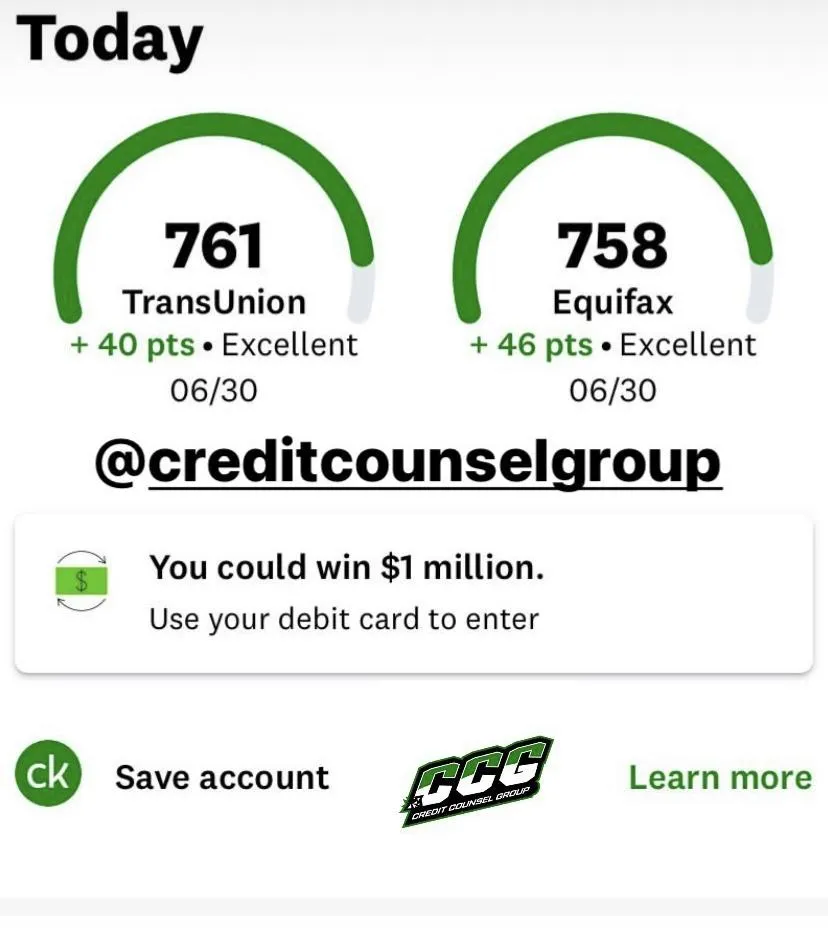

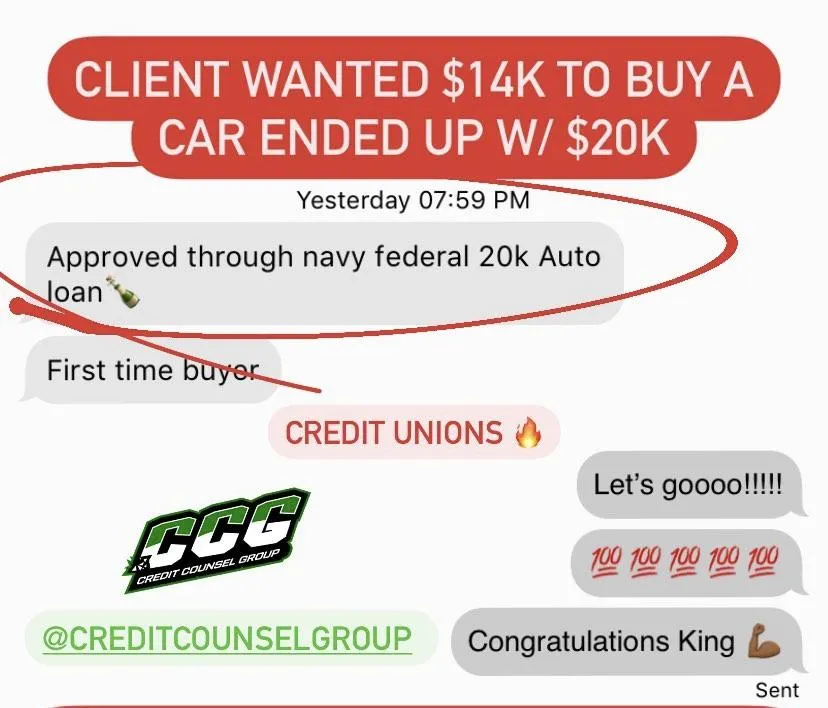

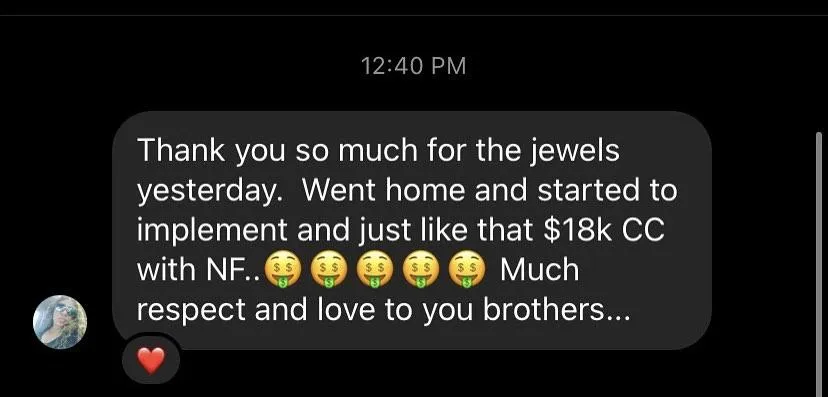

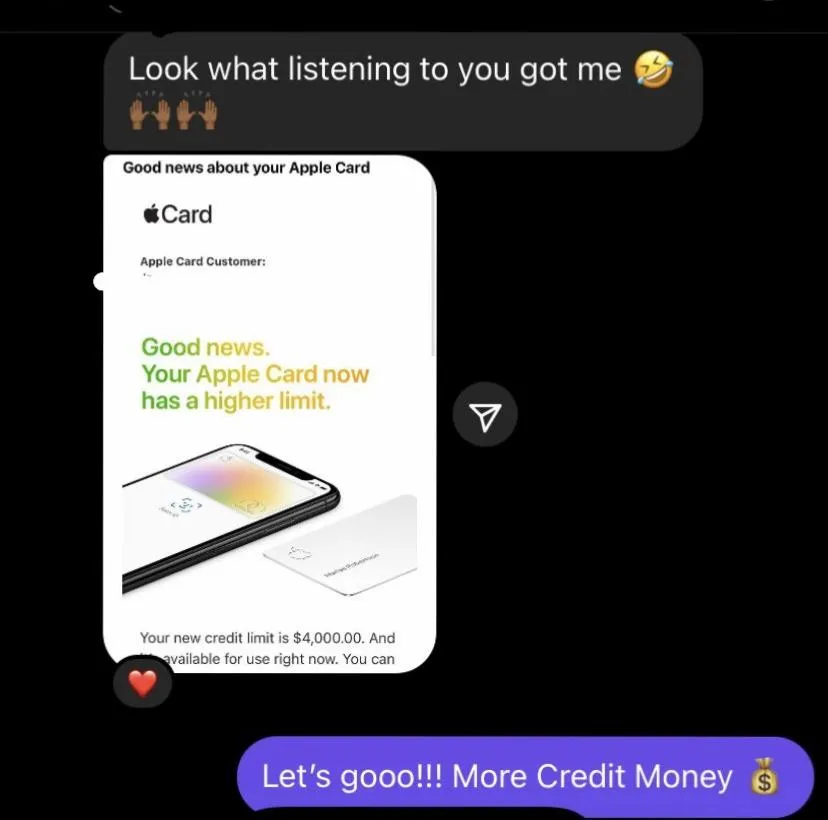

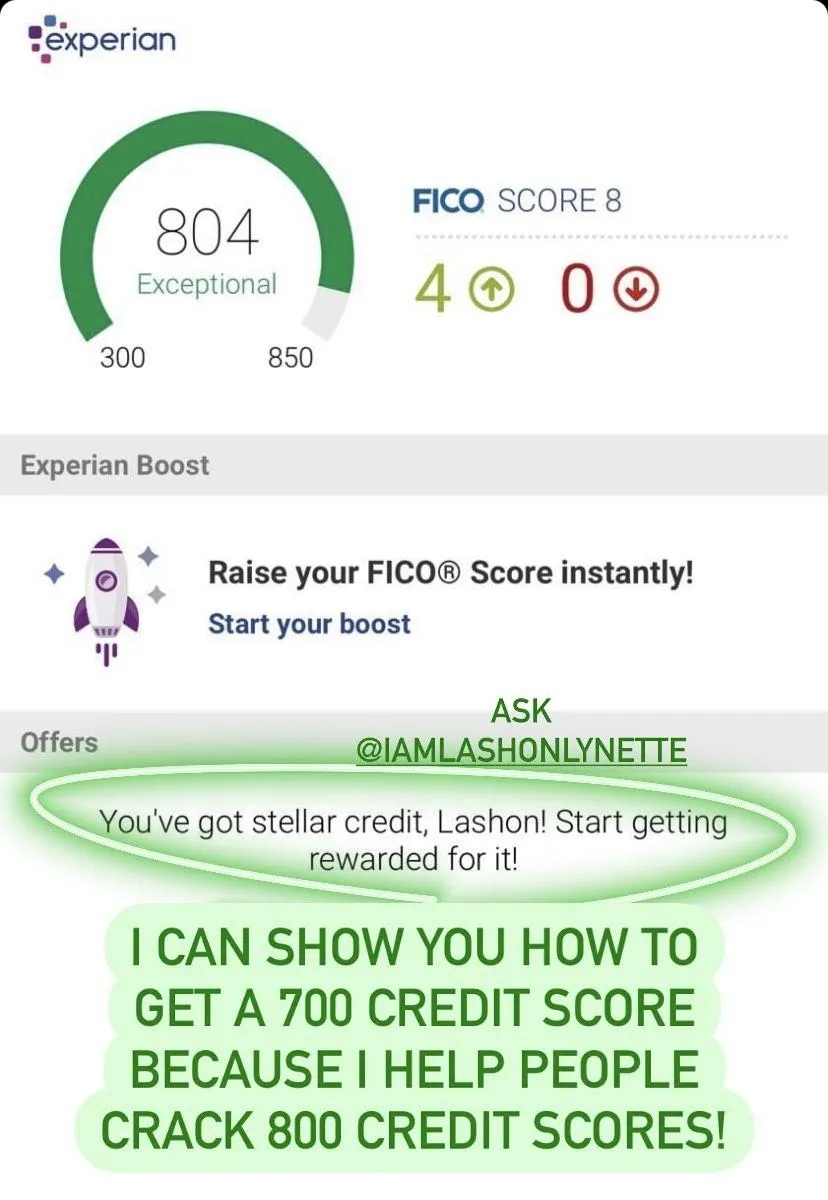

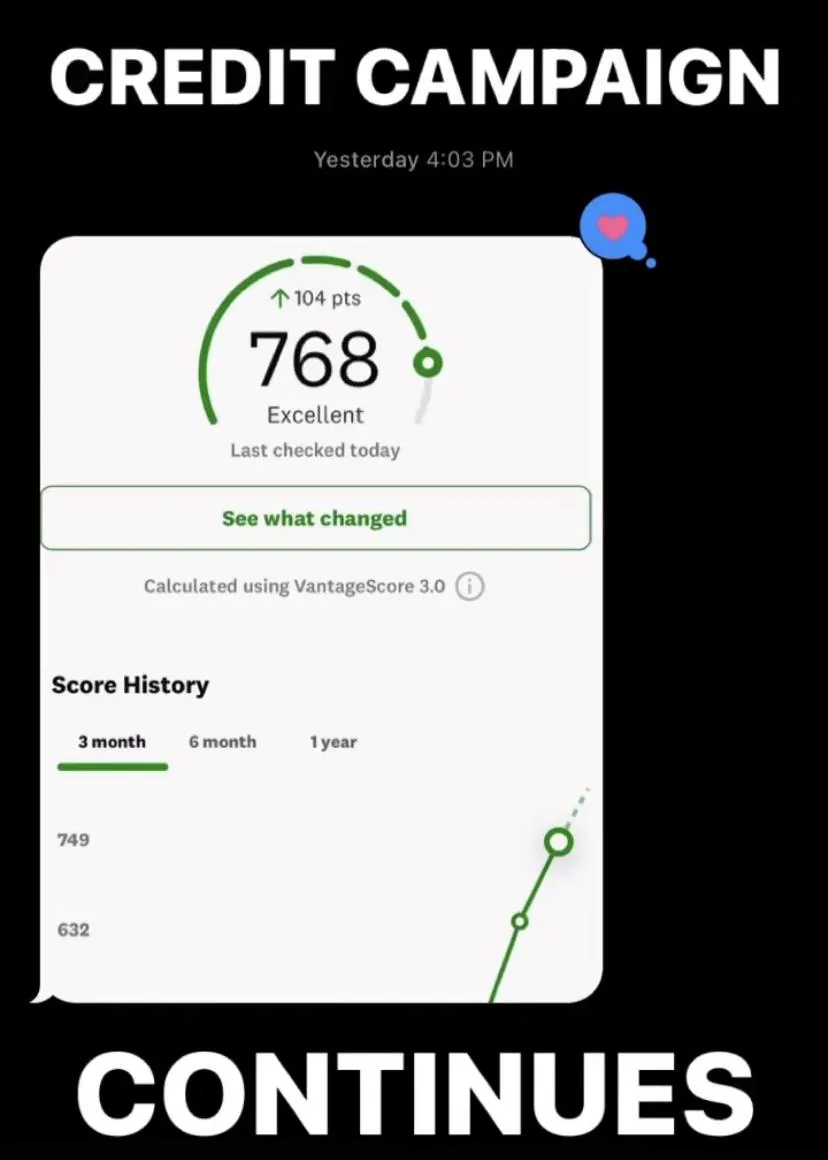

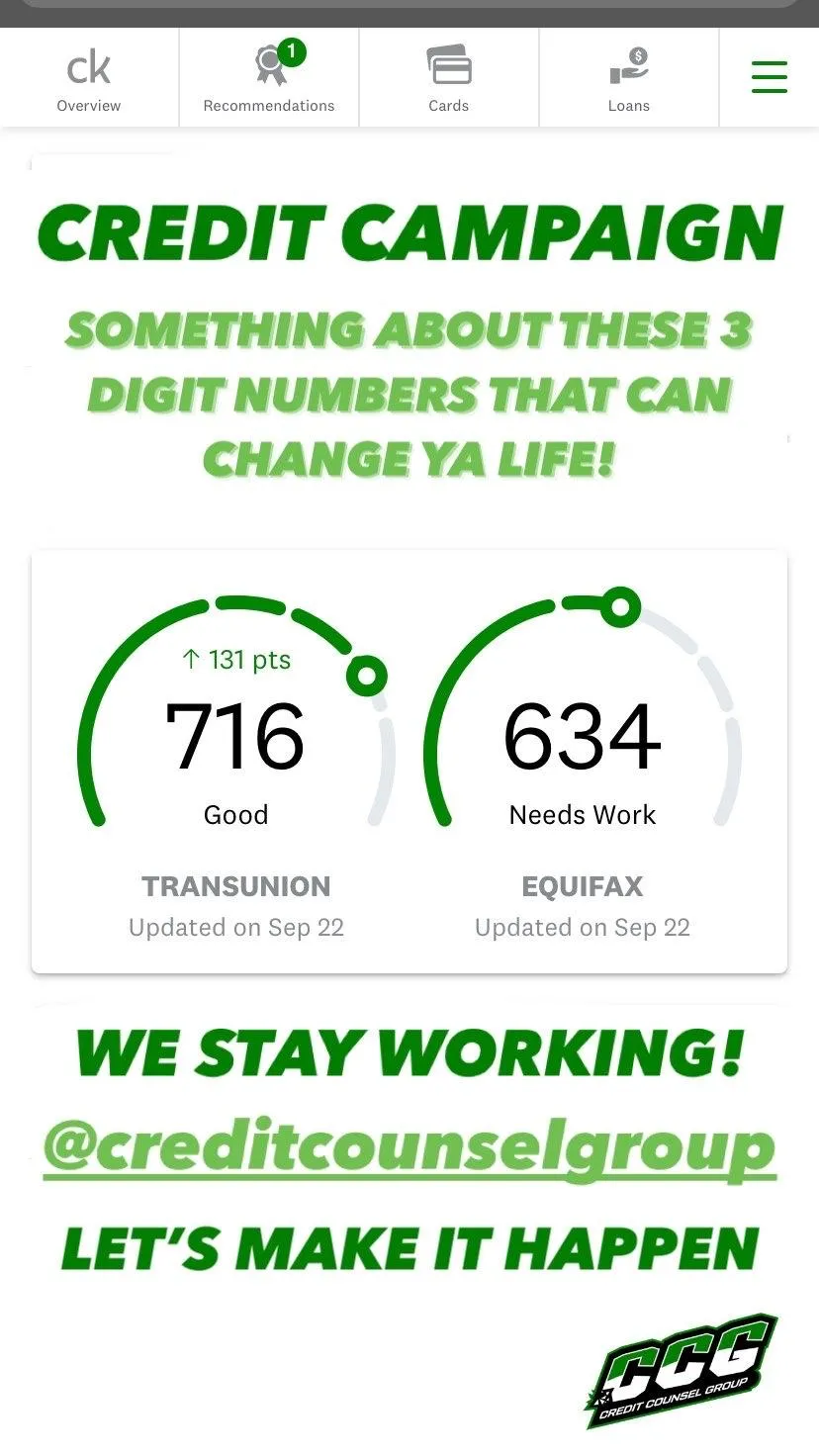

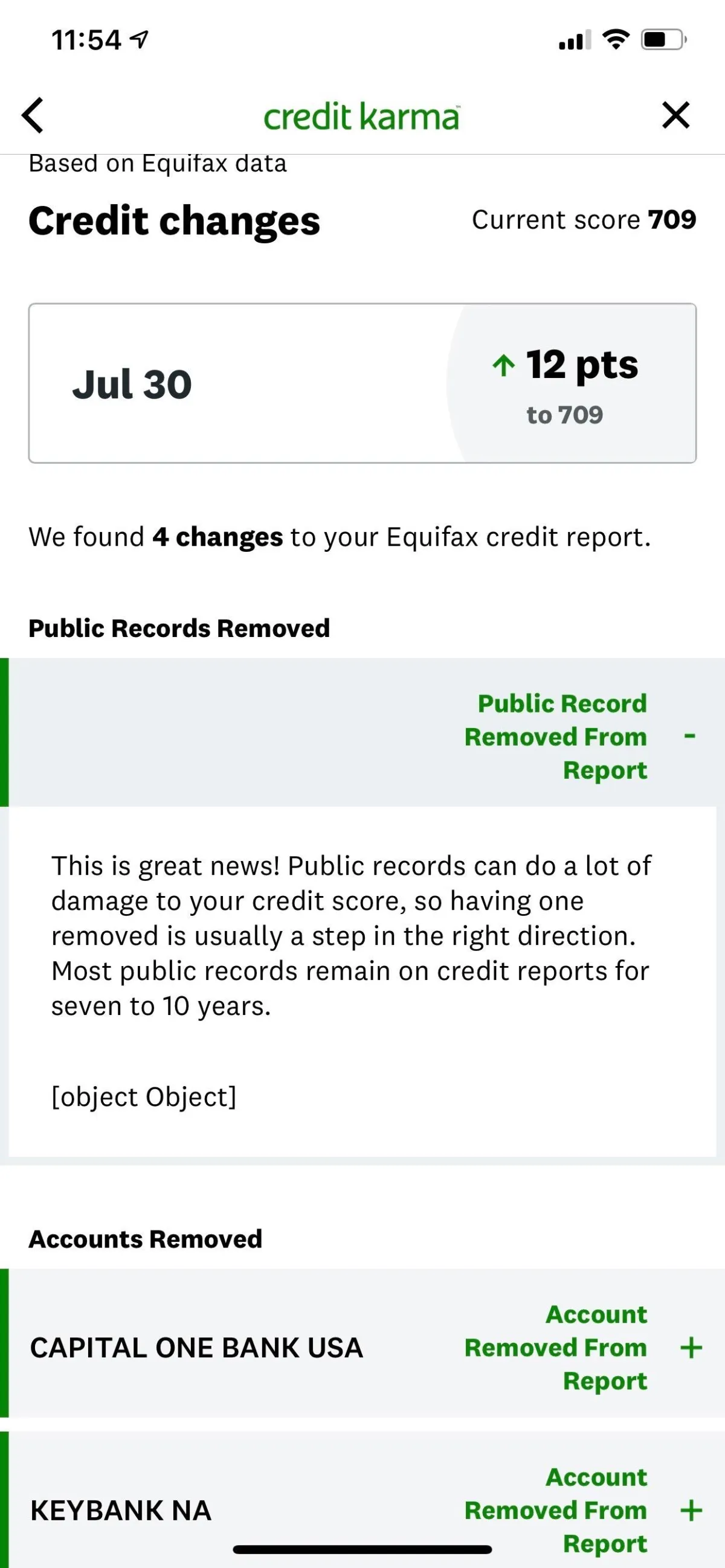

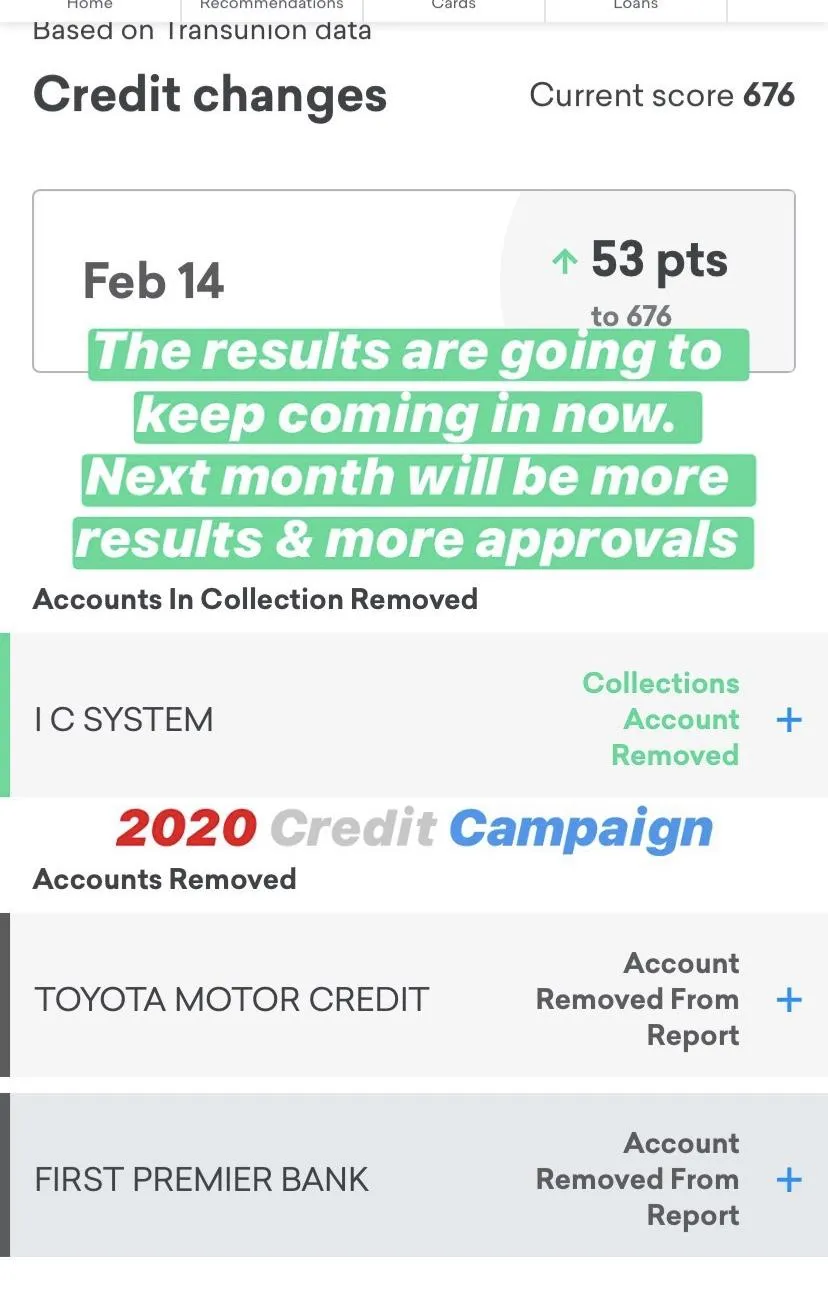

TESTIMONIALS / RESULTS

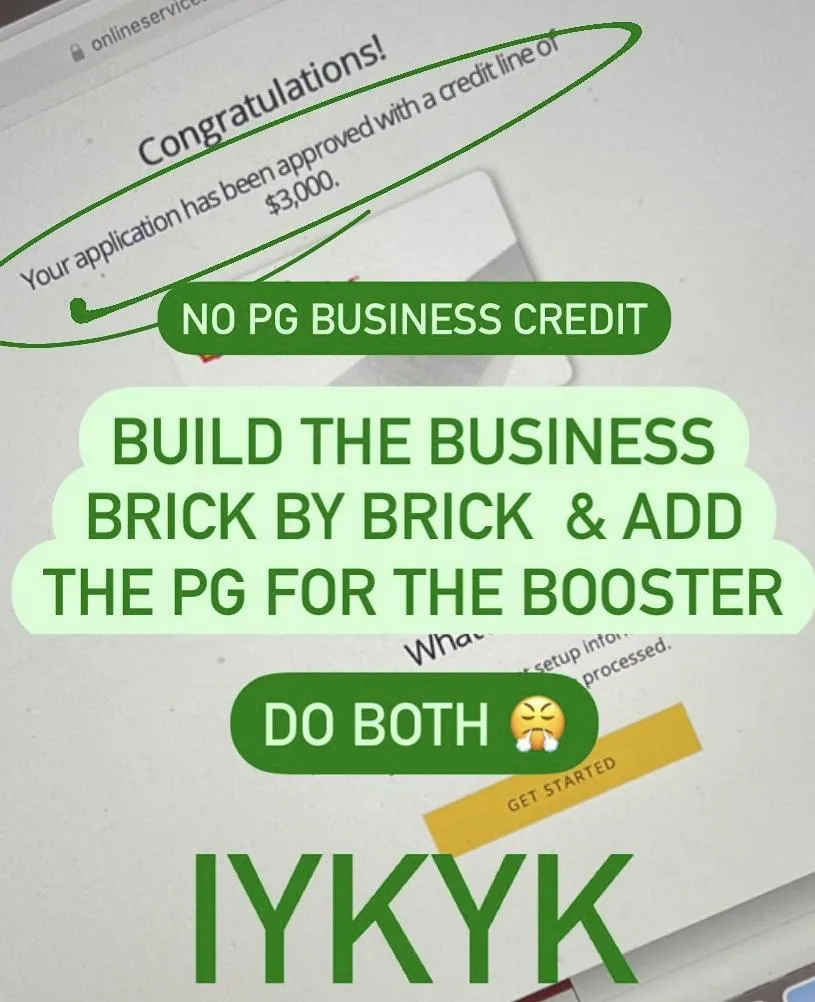

HERE'S SOME APPROVALS

FROM CLIENTS

MORE CREDIT SCORE TRASNFORMATIONS

MORE APPROVALS!

& MORE TESTIMONIALS

HOW IT WORKS

First, we analyze your credit reports and work with you to identify any questionable negative items hurting your score. We’ll build a custom game plan based on your unique situation.

Next, we challenge the identified negatives with the bureaus and your creditors. If they can’t prove that the items are accurate, fair and substantiated, they are required by law to remove them.

When a negative item is removed from your credit, we briefly celebrate (sometimes with cake). Then, we get back to work, tack- ling the other questionable items still on your reports.

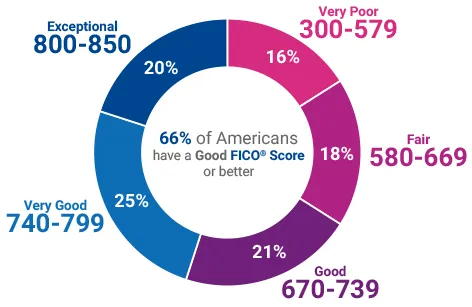

WHAT IS A GOOD FICO SCORE?

One of the most well-known types of credit score are FICO Scores, created by the Fair Isaac Corporation. FICO Scores are used by many lenders, and often range from 300 to 850. Generally, a FICO Score above 670 is considered a good credit score on these models, and a score above 800 is usually perceived to be exceptional.

WHY HAVING GOOD CREDIT MATTERS

Society is becoming increasingly dependent on using credit to make purchases and decisions.

These days, good credit is used for more than just getting a credit card or a loan.

More and more businesses are making the case that you must have good credit before they extend products or services to you.

- It Affects Where You Live and How Much You Pay

- It Affects What You Drive and Your Car Payment

- It Can Affect Your Job Search

- It Affects Your Ability to Start a Business

- It Affects Other Monthly Bills

OUR MISSION:

To Improve Our Client’s Credit in a Timely Manner by Providing Affordable Credit Score Optimization Programs Tailor Made Around Their Needs.

contact@creditcgroup.com

MON - FRI 10AM- 5PM Eastern